A credit note, or credit memo, is a document issued by a seller to acknowledge a debt owed to a buyer. It’s often used for returns, overpayments, discounts, or adjustments in business transactions, with key details recorded for accounting purposes.

Format of a Credit Note

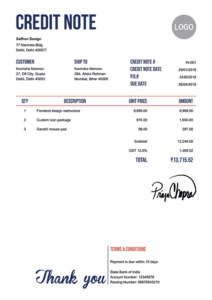

The format of a credit note typically includes the following key elements:

Header:

- Title: “Credit Note” or “Credit Memo.”

- A unique reference or credit note number.

- Date of issuance.

Seller Information:

- Name and contact details of the seller (company or individual).

- Seller’s VAT or tax registration number (if applicable).

Buyer Information:

- Name and contact details of the buyer (customer or client).

- Reason for Credit:

- A clear and concise description of why the credit note is being issued (e.g., product return, overpayment, discount, or adjustment).

Product/Service Details:

- Description of the product(s) or service(s) related to the credit.

- Quantity and unit price (if applicable).

Credit Amount:

- The total amount being credited to the buyer.

- Any applicable taxes, fees, or deductions.

Payment Instructions:

- If the credit results in a refund, specify the payment method (e.g., check, bank transfer) and provide relevant details.

Terms and Conditions:

- Any terms and conditions related to the credit note or future transactions.

Authorized Signatures:

- Signature of the authorized representative of the seller.

- Optionally, the signature of the buyer acknowledging receipt of the credit note.

Footer:

- Any additional notes or disclaimers relevant to the credit note.

How Data Extraction for Credit Notes Can Help Your Business?

Data extraction for credit notes streamlines processes, enhancing efficiency, accuracy, and cost savings. It accelerates refund processing, aids decision-making, ensures compliance, and integrates seamlessly, offering a competitive edge and improved financial management.

How to Extract Data from Credit Notes Manually?

Here’s a step-by-step guide to manually extract data from credit notes.

Step 1: Review the Credit Note

Carefully examine the credit note document to understand its structure and content.

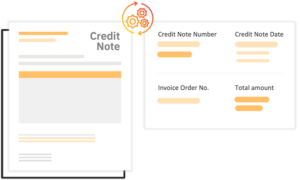

Step 2: Identify Key Data Fields

Determine the essential information to extract, such as credit note number, date, items, quantities, prices, and any relevant details.

Step 3: Manual Data Entry

Manually enter the identified data into a spreadsheet, accounting software, or a data management system. Ensure accuracy during this process.

Step 4: Cross-Verification

Double-check the entered data for errors or discrepancies. Verify that the data matches the information on the credit note.

Step 5: Documentation

Keep a record of the manually extracted data, including the source credit note and any reference numbers.

Step 6: Review and Validation

Review the extracted data to ensure it aligns with your accounting or business requirements.

Step 7: Data Storage

Store the credit note securely via Print, or Email.

How to Automate Data Extraction for Credit Notes?

Automating data extraction for credit notes can significantly improve efficiency and accuracy. Here’s how to do it:

Step 1: Choose an Automation Tool

Select a data extraction tool or software designed for financial documents, such as credit notes.

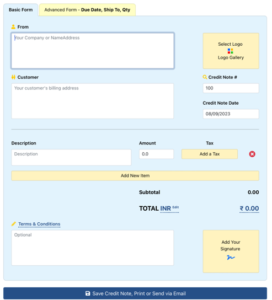

Step 2: Data Capture Setup

Configure the software to capture specific data fields from credit notes, such as credit note numbers, dates, items, quantities, and prices.

Step 3: Template Creation

Some tools use templates to identify data fields. Create templates that match various credit note formats commonly used in your business.

Step 4: OCR Technology

Many solutions utilize Optical Character Recognition (OCR) technology to convert printed or handwritten text into machine-readable data.

Step 5: Data Validation

Implement validation rules to ensure extracted data is accurate and matches predefined criteria. This step reduces errors.

Step 6: Integration

Integrate the data extraction tool with your accounting software, ERP system, or database to automate data transfer seamlessly.

Step 7: Review and Correction

Set up a review process to check for any discrepancies or errors in the extracted data. Correct any issues as needed.

Step 8: Data Storage and Archiving

Store the extracted data securely and archive the original credit notes for compliance and auditing purposes.

Step 9: Download Data

After automated extraction and validation, securely download the extracted data for use in your accounting, reporting, or other business processes.

By automating data extraction for credit notes, you can reduce manual labor, minimize errors, and expedite the processing of financial transactions, ultimately improving your business’s overall efficiency and accuracy.

Manual Vs Automated Data Extraction for Credit Notes

While manual data extraction is feasible for occasional credit notes, it can be time-consuming and error-prone for large volumes.

Consider automated solutions like KlearStack for improved efficiency and 99% accuracy in handling credit note data for business operations.

| Manual Extraction | Automated Extraction Using KlearStack | |

| Accuracy | x | ✓ |

| Quality | x | ✓ |

| Different Languages | x | ✓ |

| Integration with Existing Systems | x | ✓ |

| Data Security | x | ✓ |

| Handling Diverse Formats | x | ✓ |

| Handling Large Volumes | x | ✓ |

Why KlearStack is the Best Choice to Automate Data Extraction for Credit Notes?

Extract data from your credit notes with 99% accuracy, saving 70% costs and time. Capture, convert and analyse data from any jpg, png, tiff, bmp, pdf document without templates.

Easy setup. Cancel anytime.

With KlearStack AI, you can:

- Eliminate Manual Data Entry: Bid farewell to time-consuming manual data entry and document handling.

- Classify and Categorize Documents: KlearStack’s AI can classify and categorize various types of documents, such as invoices, purchase orders, contracts, and legal documents.

- Extract Relevant Information: It efficiently extracts relevant data from these documents, improving 99% accuracy and reducing errors.

- Validation and Comparison: KlearStack’s self-learning algorithm ensures accuracy by comparing the extracted data to the original and allows for inputting missing metadata.

- Template-Free Data Extraction: KlearStack’s template-free approach provides flexibility in handling diverse document formats, simplifying the extraction process.

- Seamless Integrations: The system seamlessly integrates with various systems through open RESTful APIs, offering out-of-the-box compatibility with systems like SAP and QuickBooks.

- Data Security and Compliance: KlearStack prioritizes data security, exclusivity, and compliance, ensuring that sensitive information remains protected.

- Easy Setup and Cancelation: Setting up KlearStack is straightforward, and you have the freedom to cancel anytime, offering convenience and flexibility.

Conclusion

With KlearStack Credit Note OCR, you’re certain to eliminating manual data entry, seek template-free flexibility, and ensure 99% accuracy,

Say goodbye to the limitations of templates and manual entry, and embrace the future of automated, Credit Note OCR: KlearStack.

FAQs on How to Extract Data from Credit Notes

Where do you record details from a credit note received?

Record credit note details in your accounting software or ledger. Include the credit note number, date, amount, and reasons for the credit, ensuring accurate bookkeeping.

How do you work out credit notes?

Calculate credit notes by subtracting the credit amount from the original invoice total. Ensure that the credit reason is valid and accurately reflected in your accounting records.

What can you do with a credit note?

Credit notes are used for refunds, adjustments, or compensation in business transactions. They can offset future purchases, issue refunds, or rectify billing errors.

What is an example of a credit note?

An example of a credit note is when a customer returns defective goods and receives a credit note for the purchase amount, allowing them to make another purchase or receive a refund.