Why people book losses in stock market during march: Booking losses in the stock market during March can be attributed to various factors, both market-related and psychological. Here are some reasons why people may tend to book losses during this month:

Benefits of booking losses in Stock Market during March

Tax Considerations: In many countries, March is the end of the fiscal year or tax year. Investors may choose to sell losing positions to offset capital gains and reduce their tax liabilities. This phenomenon, known as tax-loss harvesting, often leads to increased selling pressure in the stock market during March.

Quarterly Performance Reviews: March marks the end of the first quarter for many companies, leading to quarterly performance reviews and earnings releases. If a company’s performance falls short of expectations or if guidance is revised downwards, investors may choose to sell their holdings to cut losses or reallocate capital to more promising opportunities.

Also Read: Importance of Candlestick Patterns: Understanding Basics of Trading

Market Volatility: March often witnesses heightened market volatility, driven by factors such as economic data releases, corporate earnings reports, geopolitical events, and policy announcements. Increased volatility can lead to erratic price movements, triggering panic selling among investors who fear further losses.

Market Seasonality: Some investors believe in market seasonality patterns, such as the “March effect” or “March downturn,” which suggest that stock prices tend to decline in March historically. While these patterns are not always reliable indicators of future performance, they can influence investor behavior and contribute to selling pressure during this month.

Also Read: List of Top 10 Battery Manufacturing Companies in India

Psychological Factors: Investor psychology plays a significant role in decision-making during periods of market uncertainty. Fear, greed, and herd mentality can drive irrational behavior, causing investors to panic sell or follow the crowd without considering the underlying fundamentals of their investments. Emotional responses to market fluctuations can lead to impulsive decisions and booking losses.

Macroeconomic Concerns: March is often a time when investors reassess their outlook on the global economy and financial markets. Concerns about economic growth, inflation, interest rates, trade tensions, or other macroeconomic factors can weigh on investor sentiment and prompt profit-taking or risk aversion.

Also Read: List of Top 20 EV Charging Station Companies in India and Their Future Prospects

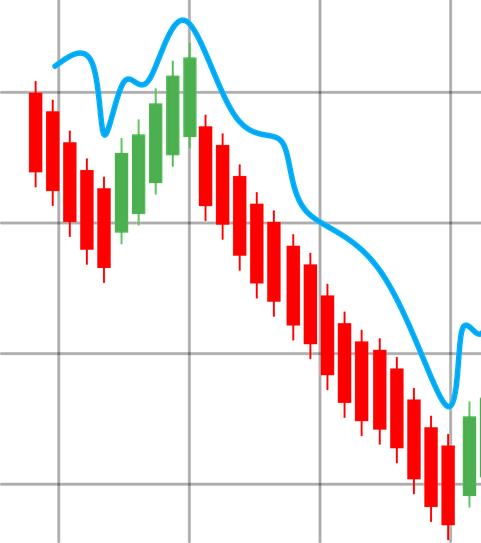

Technical Analysis Signals: Technical traders may rely on chart patterns, indicators, and trend analysis to make trading decisions. If technical signals point to a bearish trend or indicate weakness in certain stocks or sectors, traders may choose to sell their positions to avoid further losses or capitalize on short-term trading opportunities.

Year-End Portfolio Rebalancing: Institutional investors, fund managers, and pension funds often engage in year-end portfolio rebalancing activities, adjusting their asset allocations to align with investment mandates, risk profiles, or performance targets. This rebalancing process may involve selling underperforming assets, including stocks, which can contribute to selling pressure in the market.

Also Read: How to choose best stocks for long term investment; a step by step guide

Overall, while March may see increased selling activity in the stock market for various reasons, it’s essential for investors to maintain a long-term perspective, focus on fundamental analysis, and avoid making impulsive decisions based on short-term market fluctuations. Diversification, risk management, and disciplined investment strategies can help mitigate losses and navigate market volatility effectively.

Also Read: The Growing Trend of Mutual Funds in India