Volume and Open Interest in Trading: In the realm of financial markets, where information is power, traders rely on a plethora of indicators to decode market sentiment and make informed decisions. Among these indicators, volume and open interest stand out as crucial metrics that provide valuable insights into the dynamics of supply and demand, as well as the level of market participation.

Volume and Open Interest in Trading

Understanding the nuances of volume and open interest is essential for traders seeking to navigate the complexities of trading effectively. In this article, we delve into the significance of volume and open interest in trading, exploring their definitions, interpretations, and practical implications.

Volume in Trading

Volume refers to the total number of shares or contracts traded during a given period, such as a trading day. It serves as a measure of market activity and liquidity, reflecting the intensity of buying and selling pressure. High volume typically accompanies significant price movements, indicating strong investor interest and potential trends, while low volume may signal indecision or lack of conviction among market participants.

Also Read: Importance of Candlestick Patterns: Understanding Basics of Trading

Interpreting Volume:

Volume Patterns: Analyzing volume patterns can provide valuable insights into market sentiment and potential price movements. For example, increasing volume during an uptrend confirms bullish momentum, while decreasing volume during a rally may signal weakening conviction and potential trend reversal.

Volume Spikes: Sharp increases in trading volume relative to average levels often coincide with significant market events or news catalysts. These volume spikes can provide early indications of potential trend reversals or acceleration of existing trends, alerting traders to potential trading opportunities.

Also Read: List of Top 10 Battery Manufacturing Companies in India

Open Interest in Trading:

Open interest refers to the total number of outstanding contracts for a particular financial instrument, such as options or futures contracts. Unlike volume, which measures trading activity within a specific period, open interest represents the number of contracts that have not been settled or closed out. It reflects the level of market participation and the degree of investor interest in a particular security or derivative.

Also Read: List of Top 20 EV Charging Station Companies in India and Their Future Prospects

Interpreting Open Interest:

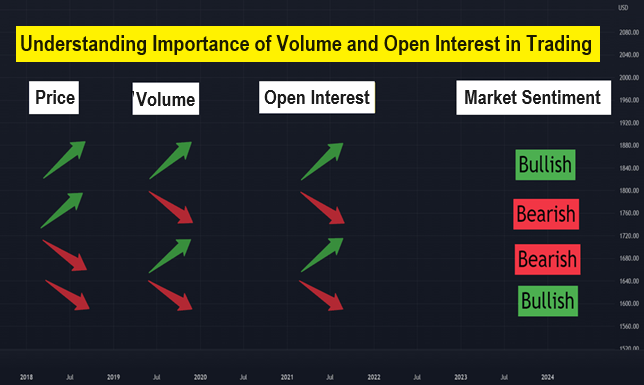

Trend Confirmation: Changes in open interest can confirm the strength or weakness of a prevailing trend. Rising open interest in conjunction with price increases suggests bullish sentiment and validates the uptrend. Conversely, declining open interest amid rising prices may signal a lack of conviction and potential trend reversal.

Option Strategies: Open interest is particularly relevant in options trading, where it indicates the number of outstanding option contracts at various strike prices. High open interest at specific strike prices can act as support or resistance levels, influencing option pricing and strategy selection.

Also Read: How to choose best stocks for long term investment; a step by step guide

Combining Volume and Open Interest:

Volume-Open Interest Ratio: Comparing volume to open interest can provide additional insights into market dynamics. A high volume-open interest ratio suggests strong participation and conviction among traders, increasing the likelihood of sustainable price movements. Conversely, a low ratio may indicate speculative activity or market indecision.

Practical Implications for Traders:

Confirmation Signals: Traders can use volume and open interest to confirm or validate their trading decisions. Divergences between price movements and volume/open interest can signal potential reversals or trend continuations, helping traders adjust their strategies accordingly.

Also Read: Top 10 Solar Panel Company in India

Risk Management: Analyzing volume and open interest can aid in risk management by identifying periods of heightened volatility or market uncertainty. Traders can use these indicators to gauge market sentiment and adjust their position sizes or risk exposure accordingly.

Conclusion:

Volume and open interest are indispensable tools in the arsenal of every trader, providing valuable insights into market sentiment, participation, and potential price movements. By mastering the interpretation of these metrics, traders can enhance their decision-making process, improve risk management, and capitalize on profitable trading opportunities in the dynamic world of financial markets.

Hope you liked this article about volume and open interest in trading and it helped you understanding the concept of Volume and Open Interest.

Also Read: Manufacturing Process and Materials Used in Battery Production

Also Read: Importance of Candlestick Patterns: Understanding Basics of Trading