Four Week Rule in Stock Market: In the dynamic world of stock market investing, various strategies and techniques are employed to navigate the complexities of financial markets. One such strategy that has gained prominence is the Four Week Rule, a simple yet powerful approach that aims to capitalize on short-term market trends. In this article, we delve into the principles of the Four-Week Rule and explore how investors can use it to make informed decisions in the stock market.

Understanding the Four Week Rule in Stock Market

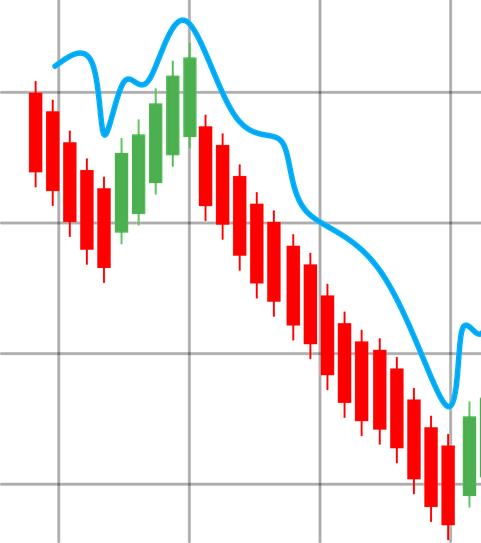

The Four Week Rule, also known as the Four Week Moving Average Rule, is a trend-following strategy based on the principle of momentum investing. The rule involves monitoring the closing prices of a stock or market index over a four-week period and making buy or sell decisions based on whether the current price exceeds or falls below the four-week moving average.

Also Read: Importance of Candlestick Patterns: Understanding Basics of Trading

Implementation of the Four Week Rule:

To implement the Four Week Rule, investors first calculate the four-week moving average by summing the closing prices of the past four weeks and dividing by four. They then compare the current closing price to this moving average. If the current price closes above the four-week moving average, it is considered a buy signal, indicating that the stock or market is experiencing upward momentum. Conversely, if the current price closes below the moving average, it is a sell signal, suggesting that the trend may be reversing.

Also Read: The Growing Trend of Mutual Funds in India

Benefits of the Four Week Rule in Stock Market:

Four Week Rule offers several advantages for investors seeking to capitalize on short-term market trends. Firstly, it provides a clear and objective framework for decision-making, helping investors avoid emotional biases and subjective judgments. Additionally, by focusing on short-term price movements, the rule enables investors to take advantage of momentum and capitalize on emerging trends in the market.

Also Read: List of Top 10 Battery Manufacturing Companies in India

Four Week Rules Limitations and Considerations:

While the Four-Week Rule can be a valuable tool for investors, it is not without its limitations. Like any investment strategy, it is subject to market volatility and may not always accurately predict future price movements. Moreover, the rule may result in whipsaw trades, where investors are caught in false signals as prices fluctuate around the moving average.

Also Read: 10 Reasons Behind Stock Market Corrections: Understanding Stock Price Corrections

Conclusion:

Four-Week Rule is a simple yet effective strategy for investors looking to capitalize on short-term market trends. By employing a systematic approach based on momentum investing principles, investors can make informed buy or sell decisions that align with prevailing market conditions. While the rule is not foolproof and may encounter occasional setbacks, it can serve as a valuable tool in the arsenal of the savvy investor. As with any investment strategy, it is essential to conduct thorough research, exercise prudence, and consider risk management techniques to optimize outcomes in the stock market.

There are many rules in stock market, but no one is 100% perfect. If you wish to book profit from stock market then focus on learning and make your own rule and technique from which you can make profit. Rigorous focus on daily charts and understanding movements of charts, understanding candlesticks, chart patterns, research of scholors about stock market, various rules like four week rule and a lot of experience can make you earn money from stock market

Also Read: List of Top 20 EV Charging Station Companies in India and Their Future Prospects