Stock market corrections are a natural part of the market cycle, characterized by temporary declines in stock prices after periods of significant growth. While corrections can be unsettling for investors, they serve as a mechanism for restoring market equilibrium and correcting overvalued assets. Understanding the reasons behind stock market corrections can help investors navigate volatile market conditions and make informed investment decisions. Here are ten common reasons why stock prices may correct:

10 Reasons Behind Stock Market Corrections

1. Overvaluation:

One of the primary reasons for stock market corrections is overvaluation, where stock prices exceed their intrinsic value. When investor sentiment becomes overly optimistic, fueled by factors such as excessive speculation or unrealistic earnings expectations, stock prices may rise to unsustainable levels, prompting a correction to bring prices back in line with fundamentals.

2. Economic Indicators:

Economic indicators such as GDP growth, inflation rates, and unemployment levels can influence stock prices. Negative economic data or concerns about future economic prospects can trigger selling pressure in the stock market, leading to price corrections as investors adjust their expectations and risk assessments.

Also Read: Importance of Candlestick Patterns: Understanding Basics of Trading

3. Interest Rates behind Stock Market Corrections:

Changes in interest rates, particularly monetary policy decisions by central banks, can impact stock prices. Higher interest rates can increase borrowing costs for businesses and consumers, potentially slowing economic growth and corporate earnings, which may prompt a correction in stock prices as investors reassess their valuations.

4. Geopolitical Events:

Geopolitical events, such as wars, conflicts, or diplomatic tensions, can create uncertainty and volatility in the stock market. Concerns about geopolitical instability or its impact on global trade, supply chains, and business operations can lead to stock price corrections as investors seek to mitigate risk and protect their investments.

Also Read: List of Top 10 Battery Manufacturing Companies in India

5. Corporate Earnings:

Quarterly earnings reports and corporate performance can significantly influence stock prices. Disappointing earnings results, revenue misses, or downward revisions to future guidance can trigger selling pressure in the stock market, causing corrections as investors adjust their expectations and valuation metrics.

6. Market Sentiment:

Investor sentiment plays a crucial role in driving stock prices. Shifts in sentiment, driven by factors such as fear, greed, optimism, or pessimism, can lead to abrupt changes in market direction and price movements. Negative sentiment or a loss of confidence in the market can precipitate corrections as investors sell off stocks to mitigate losses or reduce exposure to risk.

Also Read: List of Top 20 EV Charging Station Companies in India and Their Future Prospects

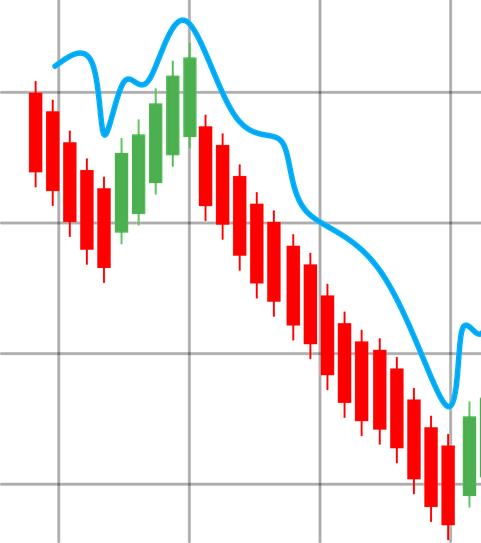

7. Technical Factors:

Technical indicators and trading patterns can also influence stock prices. Factors such as moving averages, support and resistance levels, and trading volumes can signal shifts in market momentum and investor behavior, potentially leading to price corrections as technical traders adjust their positions.

8. Sector Rotation:

Rotations between different sectors or asset classes can impact stock prices. Changes in investor preferences or shifts in market leadership from one sector to another can prompt selling pressure in the outperforming sectors and buying interest in previously overlooked or undervalued sectors, resulting in price corrections.

Also Read: How to choose best stocks for long term investment; a step by step guide

9. Liquidity Concerns:

Liquidity constraints or funding pressures in the financial markets can exacerbate stock market corrections. Tightening credit conditions, margin calls, or forced liquidations can lead to selling pressure as investors seek to raise cash or meet financial obligations, driving down stock prices in the process.

10. Market Exuberance:

Periods of excessive market exuberance or euphoria, often characterized by speculative bubbles or frenzied buying activity, can precede stock market corrections. When asset prices become detached from their underlying fundamentals or reach unsustainable levels, a correction becomes inevitable as reality sets in and investors reevaluate their positions.

Also Read: Top 10 Solar Panel Company in India

Conclusion:

Stock market corrections are a natural and healthy part of the market cycle, serving to recalibrate prices, rebalance investor portfolios, and remove excesses from the market. While corrections can be unsettling, understanding the underlying reasons behind price adjustments can help investors navigate volatile market conditions and maintain a disciplined investment approach. By staying informed, focusing on long-term fundamentals, and maintaining a diversified portfolio, investors can weather stock market corrections and position themselves for future growth and success.

Also Read: Volume and Open Interest in Trading: Understanding the Key Indicators for Traders